A FP&A Leader’s Guide to Recruiting Data: Metrics that Improve Payroll Forecast Accuracy

Table of Contents

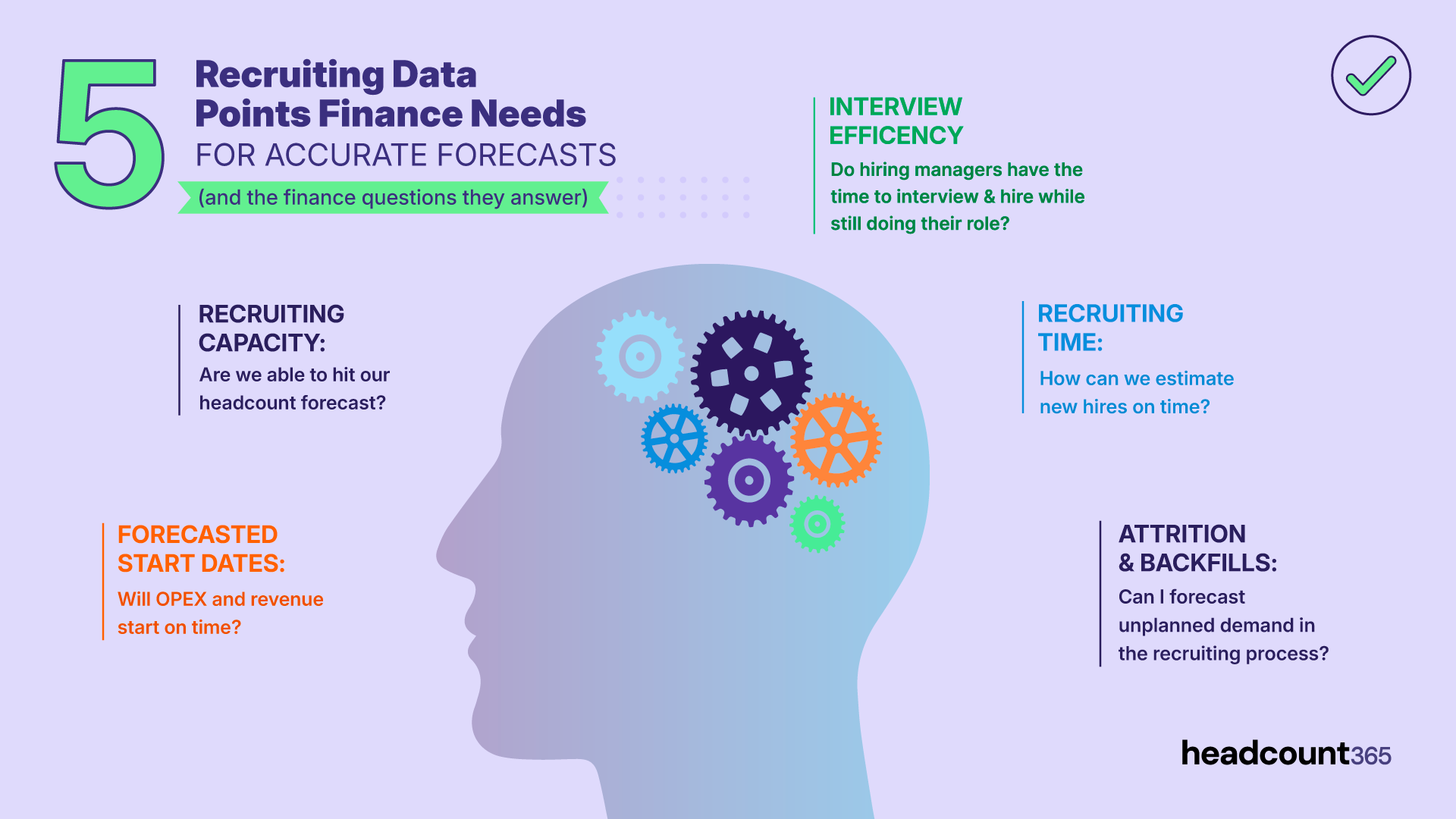

Understanding and interacting effectively with recruiting data can significantly enhance decision-making and ensure that financial resources are optimally utilized. headcount365 creates a real time connection between finance and the hiring manager changes & recruiting activity to streamline the financial data needed to run an efficient FP&A practice. Here are five key data points finance leaders should focus on:

Forecasted Start Dates Data: Impact on OPEX and Headcount Forecasts

The start date of a candidate has a direct impact on the operating expenses (OPEX) for the current fiscal year. Accurate start dates are crucial for precise net-new headcount forecasts, ensuring that finance has the best data to make informed decisions regarding OPEX. A direct connection between the ATS (Applicant Tracking System) and the actual start date means finance can predict at any time the in-year cost of an employee without needing a meeting or a reconciliation.

Why It Matters: Accurate start dates ensure that planned budgets & revenue are on plan, helping avoid the fallout with execs, boards and shareholders.

The Workaround: Encourage your recruiting team to do a Feedback Friday process. 3:00pm every Friday, all requisitions are updated on the hiring plan so that finance has a weekly source of truth.

The Solution: headcount365 delivers Real Time Start Dates headcount365 creates a real-time connection between activity in the recruiting system and the record in finance. Finance Leaders will have direct access to the real-time start date prediction for every role without having to pull a report from the ATS

Recruiting Capacity vs Demand Data: Balancing Recruiter Workloads and Predictability

Recruiting capacity is the number of offers a recruiter can make per month, while recruiting demand is the number of offers a recruiter is being asked to make. When demand exceeds capacity, theres an increase in agency spend and recruiter staffing while simultaneously degrading revenue predictability.

Why It Matters: Recruiters have a limited amount of production, and their capacity to do work is a key input to a predictable OPEX or Revenue forecast. Furthermore, when demand exceeds capacity, high-cost recruiting agencies are used to supplement recruiting capacity

The Workaround: Build an excel-based capacity demand forecast on top of your headcount plan. Prior to building HC365, I used this one across multiple big-tech firms and as an operating partner for VC.

Unicorn Talent’s Excel-Based Recruiting Capacity & Demand Planner

The Solution: headcount365 has an AI-enhanced, live Capacity Demand Forecast: A real-time hiring plan combines machine learning time to fill data with ATS data to give finance a look into

Hiring Manager Interview Capacity Data: Ensuring Efficient Interview Processes

Hiring managers have limited time for interviews. Excessive demand on their time can prevent them from performing their primary job responsibilities effectively, leading to delays in the recruitment process.

Why It Matters: Even when the recruiting team can fill the funnel, the hiring team may not be able to complete all the interviews. This can cause an unexpected delay in hiring, which in turn, delays

The Workaround: Build a process forecast for hiring manager time and work with executives to understand the amount of interview time each team has to dedicate to the interview process. If a sales manager needs 35 hours a week to hit their sales targets, then they have 5 hours of interview time per week. If they need to do 5 interviews to make a hire, and have 10 hires to make, it’s likely they won’t have enough time.

Recruiting Time Data: Accurate Forecasting for Effective Planning

There are 4 main time zones in Recruiting. You can read more about them in our blog post: Time to Fill as a Superpower. New-to-the business roles need more time as they include creating job descriptions and interview rubrics. Higher level roles need more time for candidates to give notice from their current positions. Accurate forecasting of start dates and ensuring roles start on time provide the best data for making informed OPEX decisions.

Why It Matters: Missing start dates impacts OPEX and revenue. Building a forecast from improbable start dates creates a gap in expectations that’s a pain to reconcile during an exec, board, or shareholder meeting.

The Workaround: Set a universal start and end time for time to fill, and unify it across the company. Manually track time to fill from the ATS, and update forecasts to include these predictions. Give a 15 day buffer to give enough air cover for managing variance.

The Solution headcount365’s predictive time to fill: HC365 uses machine learning to auto-assign a predictive time to fill to each requisition. When new reqs are opened the finance team will have an accurate prediction as to when that OPEX will hit.

Attrition to Backfill Ratio: Managing Unplanned Demand

Attrition refers to the number of employees leaving the organization, while backfills are the roles that need to be refilled due to attrition. High attrition rates can lead to unplanned demand on recruiting teams, potentially exceeding their capacity. This is particularly critical for revenue-producing roles. Finance leaders with the most predictable attrition forecasts can manage these challenges more effectively.

Why It Matters: Predictable attrition forecasts help finance leaders plan for unplanned demand, ensuring that recruiting teams are not overwhelmed and that key positions are filled promptly. Knowing when the attrition will hit helps finance leaders plan for the financial & recruiting impact of the exits.

The Workaround: Use a generic attrition percentage applied in a linear fashion to predict the number of backfills every month. Collaborate with HR regularly to understand the reasons behind attrition and take proactive measures to address them.

The Solution: headcount365’s live attrition forecast: HC365 connects directly to your HRIS to forecast attrition so finance knows the second notice is put in by an employee. Our backfill replacement approvals ensure that only approved backfills are given to the recruiting team.

Conclusion

For finance leaders, effective interaction with recruiting data is not just about monitoring expenses but also about enabling strategic decision-making that supports the organization’s growth and operational efficiency. By focusing on start dates and spend, managing agency costs, balancing recruiting capacity with demand, optimizing hiring manager interview capacity, ensuring accurate recruiting time forecasts, and managing the attrition to backfill ratio, finance leaders can drive significant value from the recruiting process.

Implementing these strategies ensures that organizations remain agile and responsive to changing hiring needs while maintaining financial discipline and accountability. This holistic approach to interacting with recruiting data can significantly enhance both recruitment efficiency and financial planning.