The Role of Headcount Data in Strategic Financial Planning

Table of Contents

What is Strategic Financial Planning?

Strategic financial planning is a long-term approach to aligning financial resources with business goals. Done well, it enables sustainable growth, accurate forecasting, and business resilience. But the headcount data that underpins these plans often has low fidelity — values are updated infrequently, stripped of context, and missing critical details about how or why changes happened, who requested them, and what ripple effects they had across the rest of the financial plan.

Gaps in Today’s Strategic Financial Planning

Weak financial planning is felt by everyone, reducing budget owner autonomy, creating more work for HR & FP&A business partners, and slowing the recruiting process.

All the ways poor strategic financial planning is felt by employees.

Headcount behind a paywall. Teams do not get all of their headcount at once. Business unlocks headcount behind universal conditions that don’t apply to every tea.

Costly reconciliation meetings. Reliance on disconnected systems: HRIS, ATS, FP&A, spreadsheets creates the necessity to align everyone’s version of truth to the FP&A system. These meetings are painful as cross-functional teams try to track down the “real plan”.

Multiple sets of approvals. To make any change, there must be approvals. New hire approvals. Backfill approvals. Software spend approvals. Team change approvals. Approvals act like a speed bump for a finance to review the impact of the most recent decision-making information.

Slow financial decision-making. Strategic planning software solutions often fail to integrate headcount — the largest expense line. You must wait for the weekly reconciliation, or worse, monthly, to clear your budget.

Multiple changes to forecasts. If the number of heads you’re able to hire constantly changes, it’s because the business has to constantly reforecast with every update. Financial accountability gaps mean that another manager’s bad behavior may impact your budget.

Strategic Financial Planning Needs a Unified Dataset

Whether you’re closing the books at month-end or preparing an annual plan, the data used for financial planning should be consistent across all teams. Without it, organizations face the same recurring issues:

No shared source of truth – Finance, HR, and Recruiting each work from different numbers.

Delayed updates – Plans rely on outdated or manually reconciled data.

Variance blind spots – Salary changes, attrition, backfills, and hiring delays are hard to track.

Time-consuming – Building a plan often requires weeks of manual reconciliation.

A unified dataset reduces the endless back-and-forth on strategic financial plans by ensuring plan creators and plan consumers are working from the same information.

How Headcount Improves Strategic Financial Planning

1. Aligning Workforce and Financial Strategy

Workforce strategy cares about org design, management ratios, support staff, ramp time, and a number of variable metrics that help deliver production & revenue.

Financial strategy leverages parts of workforce planning, like job level, employment location, start date, and salary, to hit financial targets that correlate with revenue.

Unified headcount data links org planning with financial planning so that both teams can manipulate their individual variables while the other team can estimate the impact of those changes.

Read more about headcount365 Workforce planning functionality

2. Improving Long-Term Financial Planning Accuracy

Siloed headcount data without context makes it difficult to build long-term assumptions. For example:

A new sales deal requires new headcount. Is the business able to staff a new sales deal in time, or should the company build a “Bench” as a buffer?

Cyclical Turnover impacts revenue. What happens to headcount during the company’s busy seasons? How does a bonus or commission payout impact tenure?

Historical activity allows better modeling of hiring cycles, ramp periods, and turnover.

YoY headcount data turns strategic planning assumptions into educated predictions from previous years’ activity.

3. Increasing Forecast Predictability

Strategic financial plans require snapshots, but Year-over-year headcount trends (growth, attrition, backfills) help identify the trends to best interpret today’s data against YTD performance.

A unified dataset builds accuracy into every scenario, with factors like approval delays, time-to-hire, and notice periods are embedded into forecasts.

YoY headcount data reduces volatility in hiring and compensation assumptions.

4. Enhancing Collaboration Across Stakeholders

Finance, HR, and Recruiting share one version of the truth so that if one team creates a change, they have visibility & transparency into its impact on other teams.

Backfilling revenue-producing roles as an example (read our blog on predictive backfils here)

It costs less OPEX to backfill a seller after they’ve quit, but the gap in revenue could cost the business more.

A history of how budgets move across different cost centers, departments, or managers helps financial planners track the money from the initial plan to the actual.

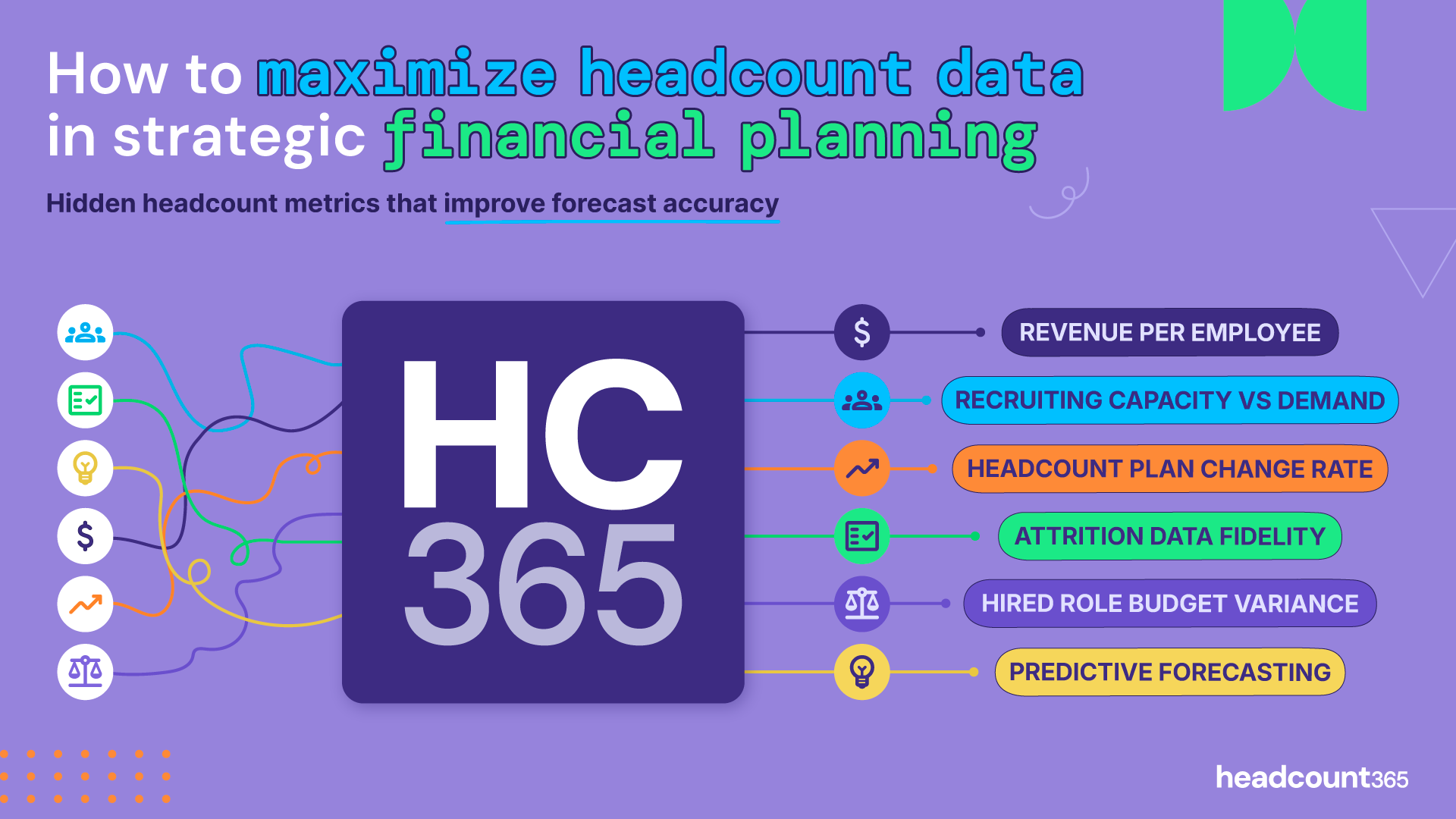

5. Accountability Through Headcount Metrics

Headcount plan change rate, hiring manager variance, and recruiting capacity vs. demand are all lost in spreadsheet calculations and trackers.

Finance teams can now identify the reasons behind headcount variance to support solutions for other stakeholders.

Recruiting capacity & sales hiring as an example

The finance team identifies that revenue growth is slow because sales hiring is slow.

FP&A support for improving recruiting performance or increasing recruiting capacity will improve the speed to resolution.

Headcount365 Stores & Enriches Headcount Data for Strategic Financial Planning

Headcount365 was built to make strategic financial planning more accurate and less painful. It extracts the pertinent headcount data needed for planning, interprets critical headcount actions to add context, and instantly connects to FP&A systems so everyone works from a unified dataset. The result is an orchestration layer that streamlines headcount workflows — capturing information as a natural byproduct of a better process and UI.

With year-over-year tracking, historical activity, and new headcount-specific metrics, headcount365 reduces the time it takes to create a strategic financial plan while improving accuracy for all stakeholders, positioning headcount data as the foundation of financial strategic planning going forward.